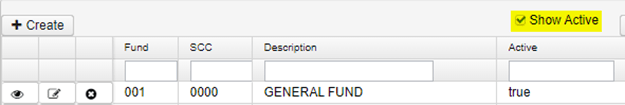

Auto Filter Active Accounts

The “Show Active” checkbox is available at the top of the Cash, Appropriation, Expenditure, and Revenue grids in USAS. By default, this checkbox will be checked, filtering the grid to show only accounts where Active = true.

This checkbox is independent for each of the different Account tabs (Cash, Appropriation, Expenditure, Revenue). If unchecked on one grid, it does not affect the grids for other account types. This checkbox will maintain the user selection. If a user unchecks the box, it will remain unchecked until it is checked again, even if the page is refreshed or the user navigates away.

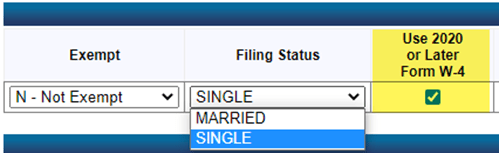

EAC What If Calculator Federal Tax Options?

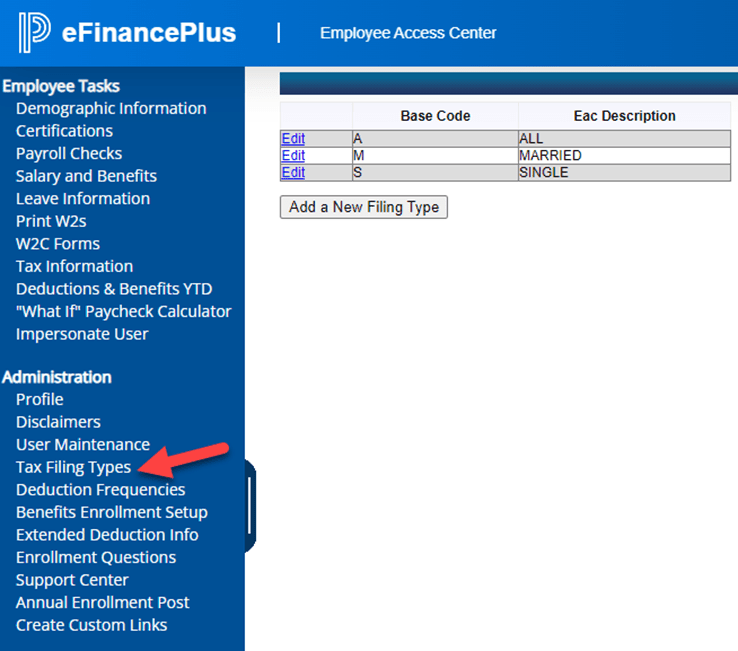

Review your Employee Access Center (EAC) “What If” Paycheck Calculator to verify if you have Head of Household as Filing Status. If you do not, the steps are easy to add it.

Step 1 As System Administrator, in the left-hand navigation click on Tax Filing Types.

Step 2

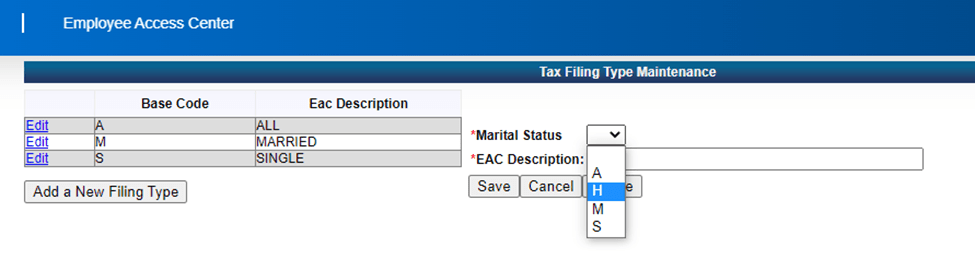

Click on Add a New Filing Type. Select Marital Status of “H” and enter EAC Description as Head of Household. Click on Save.

Step 3

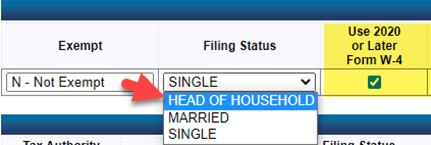

Verify under “What If” Paycheck Calculator confirm you now see Head of Household

Trainings/Meetings in April

3rd eFP Coffee Collab – Fund Accounting 9:00 AM – 10:00 AM

4th USPSr Quarter Balancing Workshop 9:00 AM – 12:00 PM

5th USxSr Tips & Tricks “New Hire Uploads” (including SERS email option) 9:30 AM – 10:30 AM

11th USXSr Redesign Reports Workshop 9:00 AM – 1:00 PM

13th USPSr STRS Advance Workshop 9:30 AM – 12:30 AM

14th eFP – Budget Preparation 9:00 AM – 3:00 PM

17th eFP Coffee Collab – HR/Payroll Topic: Rehire Terminated Employee 9:00 AM – 10:00 AM

18th Fiscal Open Lab 9:00 AM – 3:00 PM

19th USxSr Tips & Tricks “Applicable Enhancement Overview” 9:30 AM – 10:30 AM

26th Treasurer’s Operating Committee 12:00 PM – 2:00 PM

27th eFP HR/Payroll – New Hire Reporting 9:00 AM – 10:30 AM