eFP Changes to Automated Payroll Interface

In the April release, PowerSchool introduced a change in functionality to the Automated Payroll Interface that we thought you should know about, as it could potentially impact how you handle the Automated Payroll Interface. Please take a moment to review the release below:

EFIN-114174 Automated Payroll Interface restricts editing budget unit or account number.

In Fund Accounting, Periodic Routines, Automated Payroll Interface, if a user edits the charging (Budget Unit when not using full account format or Account Number when using full account format) on a record to an item with a different fund, it results in out of balance messages because the cash side of the entry still posts to the original fund, even if the Budget Unit or Account Number on the record is updated to one associated with a different fund. Both the original and the edited fund reflected out of balance messages. This has been resolved by restricting edits to the Budget Unit or Account Number on any record in Automated Payroll Interface. The Budget Unit or Account Number cannot be changed.

What this means for you:

As of now, changing the Budget Unit or account number in the Payroll Interface file will no longer be possible. If you require overrides for specific employee pay rate distributions, we recommend utilizing the Benefit Override Table. Below, you’ll find a quick step-by-step guide for configuring the table.

We’ll go deeper into this process during the Coffee Collab session on Monday, April 22nd at 9:00 am. If you’re interested in understanding more about this functionality, please register at: https://staging1.neonet.org/events/

Setting Up Benefit Charge Override Table

Setting up a Benefit Charge Override Table allows you to tailor how benefits are allocated to employees, particularly when default settings need to be overridden. Below is a simplified step-by-step guide to help you through the process:

Navigate to: Human Resources > Reference Tables > Payroll > Benefit Charge Override

Click the Plus Sign to add a Benefit Charge Override

Benefit Information

- Verify the Fiscal Year is correct.

- Pick the Priority

- The highest priority is 1. When you create records, the system assigns 1 as the priority for the first record in a series, 2 for the second record, and so forth.

- Fill out the Benefit Code for the benefit record in the deduction table that contains the default budget/unit account needing override.

- If the override is for a specific person, put in their employee number, otherwise leave it blank.

Helpful Tip: In the Benefit Charge Override Table, the wildcard symbol is $

Salary Distribution

- Fill in the budget unit and/or account you want to override.

Charge to Distribution

- Fill in the budget unit and/or account you are wanting the default budget unit or account to be assigned to.

- Click on the blue checkmark to save your setup.

Additional Notes:

When interfacing payroll to Fund Accounting, the system will now use the distribution specified in the “Charge to Distribution” section instead of the default allocation for the employee(s) pay rate.

For bulk distribution changes, you can use the import function. If assistance is required, don’t hesitate to contact your eFP Support team for guidance at 330-926-3900 or email us at fiscalhelp@neonet.org

Unvoid a voided disbursement in State Software

As of the (January 19th) 2024.0.0 release, in USAS you can un-void a voided disbursement under certain circumstances. For a voided disbursement to be eligible for the un-void process:

- The voided disbursement date must be after the 2024.0.0 release. Any voided disbursement dated before this release does not have the necessary information saved on the InvoiceItemId and, therefore, cannot be unvoided.

- The type of the voided disbursement may be for payment on a purchase order, a refund, or a payroll disbursement.

- The voided disbursement must be dated in an open posting period. This requirement keeps the figures on the accounts and the data on the reports accurate because once a transaction is created or edited in an open period, upon closing the posting period, the accounts and reports are updated.

Other limitations on unvoiding a voided disbursement would be if the invoices were deleted following the void process or if any of the items on the voided disbursement were paid on another disbursement.

- If the invoices were deleted during or after the void process, the user cannot un-void the voided disbursement due to the (deleted) invoice no longer being on the system. The user will receive an error message when attempting to un-void a voided disbursement that has deleted invoices.

- The user will also receive an error message if the voided disbursement included items that were paid on another disbursement.

Tip: To determine if any items on the voided disbursement were paid on another disbursement, view the voided disbursement from the disbursement grid to determine if it is checked. This field can also be added as a column on the disbursement grid (via the ‘More’ button), allowing you to easily filter on voided disbursements to see if the void qualifies to be unvoided.

How to Unvoid a Voided Disbursement

If the voided disbursement is eligible to be unvoided, the user would select it from the disbursement grid and click the button. A confirmation box will pop up, allowing the user to Confirm or Cancel the unvoid process.

When the user confirms to unvoid, and it is successful, the user receives an informational message that the disbursement was unvoided. The check is now back at an outstanding status.

What if my voided disbursement is not eligible for the unvoid process?

If the voided disbursement is not eligible for the unvoid process, an alternative would be to create a new check from the purchase order or invoice, depending on whether or not the ‘Void Invoice Items’ option was chosen when the check was voided. If the same check number needs to be used, the previous check can be re-sequenced to a different check number so that the original number can be used on the reissued check.

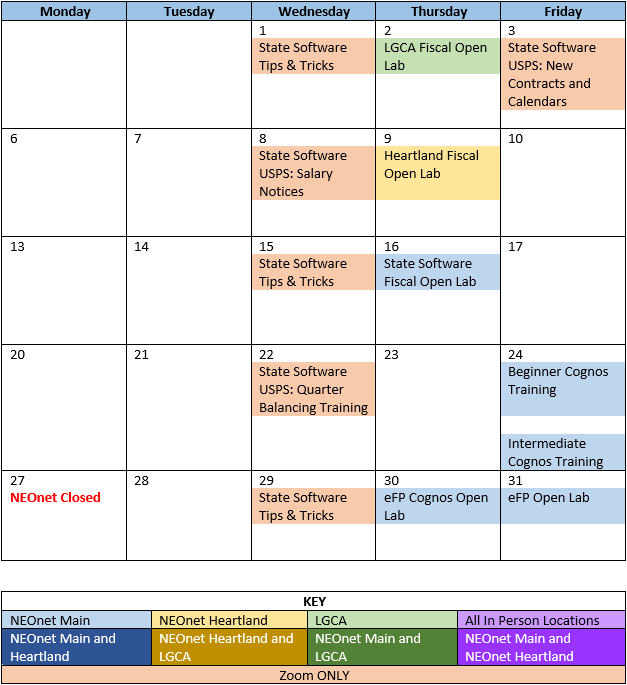

Trainings/Meetings in May