State Software Employee Self-Service Q & A

Q: What is Employee Self-Service?

A: This is the State Software replacement for the Employee Kiosk

Q: When is the deadline to migrate?

A: September 30th, 2024

Q: Does my district need to migrate to ESS

A: All districts must migrate to ESS even if they are not using Employee KIOSK for leave requests.

Q: What is happening with IPDP functionality in Employee KIOSK?

A: The IPDP functionality will remain in Employee KIOSK until July 2025. NEOnet has developed IPDP software that is free to all NEOnet districts, and your district should switch to that platform before July 2025.

To ensure a smooth transition to the new software, NEOnet offers school districts demonstration accounts to explore the redesigned IPDP software’s features and functionalities and schedule migration dates with them. Please contact Matt Gdovin at gdovin@neonet.org, Andy Melick at amelick@neonet.org, or email ipdp@neonet.org to learn more about the software, request a demonstration account or schedule your migration date to the new IPDP software.

Q: Will all pay slips, W2s, and leave history migrate to Employee Self-Service?

A: All historical pay slips and W2s will migrate to ESS. Historical leave transactions will show in ES, where it is being pulled in from Absences posted to USPS. Initially leave calendars in ESS will be blank until new leave requests are generated by employees.

Q: What is happening with the AESOP functionality in ESS?

A: In ESS, leave requests generated in ESS must be approved in ESS, and leave requests generated in AESOP must be approved in AESOP. Districts using AESOP will need to create approval workflows in AESOP, and supervisors will need to approve leave requests for employees needing a sub in AESOP. Once approved in AESOP, leave requests will flow to ESS and be available for export into USPS.

Note: For districts that wish to integrate with Absence Management (AESOP), Frontline Education has asked that you reach out by emailing absencesupport@frontlineed.com and including the note “HR Kiosk to ESS Transaction” in the subject line or body of the email. This will help route the request to their Technical Support team. There will be a required template change on the Absence Management side, and they are ready to assist.

Q: Will training on ESS be provided?

A: During migration, districts will receive a complete overview of the Software. As a refresher, the overview will be on the NEOnet Events calendar again in October. We will also provide a session on recent enhancements to ESS.

If you have not already migrated or have not scheduled a migration, please call 330-926-3900 or email fiscal@neonet.org to schedule your migration today!

PowerSchool ERP Update – Enhanced 941 Quarterly Federal Tax Return Process

We’re excited to announce updates to the 941 Quarterly Federal Tax Return process within PowerSchool ERP! These enhancements streamline your tax reporting and bring new flexibility, making it even easier to generate accurate and timely returns. Whether you’re preparing for the next quarterly submission or revisiting previous reports, the improved functionality is designed to save you time and reduce complexity.

What’s New?

- Dynamic Percentage Adjustments: The updated system allows for seamless modification of FICA, Medicare, and Federal Tax percentages directly within the Load page. These changes will no longer reset upon exiting, making it easier to fine-tune past or present reports with greater control.

- More Detailed Reporting: The update improves report generation options, allowing you to create even more granular detail reports—by check or employee summaries—giving you a clearer picture for reconciliation before submitting your return.

- Enhanced Employer Setup: Now, configuring your Employer Federal Tax ID and associating pay groups has been simplified, making initial setup faster and more intuitive. For districts with multiple tax IDs, the process of managing these records has been improved for smoother operation.

Streamlined Process for Your 941 Reports

- Employer Setup: Begin by reviewing and updating your employer records. With the enhanced user interface, it’s easier to ensure Federal Tax IDs and pay groups are configured correctly, especially for districts with multiple employer records.

- Load and Modify: The updated Load feature allows you to easily adjust percentages, even when generating reports for prior periods. Now, any modifications made to FICA and Medicare tax codes will be retained within the session for uninterrupted adjustments.

- Generate and Review Reports: Once you’ve loaded the data for your selected quarter, the enhanced report generation capabilities let you view 941 Federal Tax Returns, FICA, Medicare, and Federal Tax reports in IRS-compliant formats. You can now generate more comprehensive reports for detailed reconciliation by employee or department.

- Improved Flexibility for Voided Check Reporting: With the update, managing voided checks within your 941 process is more flexible, allowing for better tracking and integration into the final return.

Why the Update Matters:

The 941 Quarterly Federal Tax Return is a critical requirement for all districts, and this ERP update ensures that the process is more user-friendly, efficient, and accurate. These enhancements provide more control over your tax reporting, reduce manual adjustments, and help ensure compliance with the latest IRS guidelines.

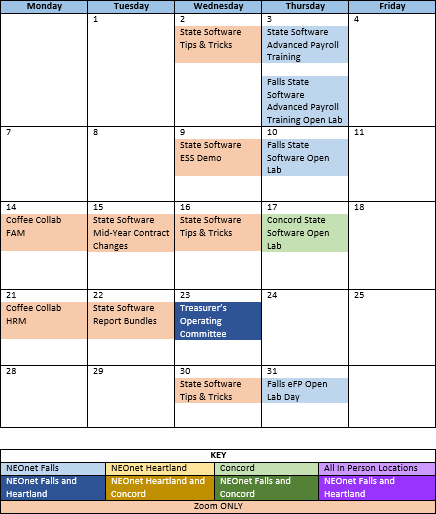

Trainings/Meetings in October