EMIS Period H Deadline Approaching – August 30, 2023

Reminder: Check our Safe Accounts to see if you have any issues with MOE

eFP Period H District Steps

Let’s review the tasks that need to be completed before the deadline.

- Verify EMIS > All > EMIS Reference Tables > EMIS Fund Class Codes Setup

- Refer to the EMIS Manual Section 6.2 and ensure that your EMIS Fund Class Codes are set up correctly.

- Double-check that your EMIS Profile is set up for the correct reporting year.

- Verify that your OPU information is correctly configured under EMIS > All > EMIS Financial Tables > Operational Unit.

- Perform your EMIS Financial Load to pull the data from Fund Accounting into the Cash Table, Expenditure Table and Receipt Table located in the EMIS Financial Tables section.

- Balance the Totals

- Balance the totals in Cash Table back to the Ohio Position Report (FAM > State > OH Cash Position Report).

- Balance the totals in Expenditure Table back to the Detail Expenditure Status Report (FAM > Reports > Expenditure Status Report > Detail Expenditure Status Report).

- Balance the totals in Receipt Table back to the Detail Revenue Status Report (FAM > Reports > Revenue Status Report > Detail Revenue Status Report).

- Once all the above steps are completed and the totals are balanced, begin working on your Cash Reconciliation Report

- If you have any federal programs and governmental agency administering of program monies, follow the Federal Assistance Summary & Detail document.

- Use the EMIS Organizational General Information document to complete your Lunch Room and Transportation Percentages along with your ITC IRN.

- For Civil Proceedings information, if any, use EMIS Statement R Detail & Descriptions page.

- Once the above steps have been completed run the EMIS Data Export to pull your financial data for submission in the data collector. Review any issues and resolve within eFP.

STRS Advance Report

The Check STRS Advance Report (a report of the amounts sent to STRS over the summer pays) is an easy way to assist in determining the balancing discrepancies.

- Go to Reports>STRS Reporting>Check STRS Advance.

- Start Date = Period ending date of the first pay in July.

- End Date = Period ending date of the last pay of the fiscal year.

- Sort By = Choose the same sort option that was selected for the STRS Advanced Positions Report.

The Check STRS Advance Report can be compared to the STRS Advanced Positions Report (created during the fiscal year end closing process). If you need the STRS Advanced Positions Report, a copy of the report can be generated by going to Utilities>File Archive>2022 Fiscal Year Reports>STRS Advanced Positions Report. For each employee listed, the amount listed as ‘Total Amount Advanced’ on the STRS Advance Positions Report should match the ‘STRS Advance Amounts’ on the Check STRS Advance Report.

Any discrepancies will need to be reported to STRS. To avoid this year’s STRS balancing issues affecting next fiscal year’s annual reporting, the discrepancies filed with STRS will need to be posted to USPS using Core>Adjustments selecting the appropriate payroll item, type, transaction date, and amount for the fiscal year. These adjustments could include the following:

- 450 Payroll Item – Total Gross, Transaction Date of 06/30/22, for the Fiscal Year to Date.

- 591 Payroll Item – Amount Withheld, Transaction Date of 06/30/22, for the Fiscal Year to Date.

691 Payroll Item – Board’s Amount of payroll item, Transaction Date of 06/30/22, for the Fiscal Year to Date.

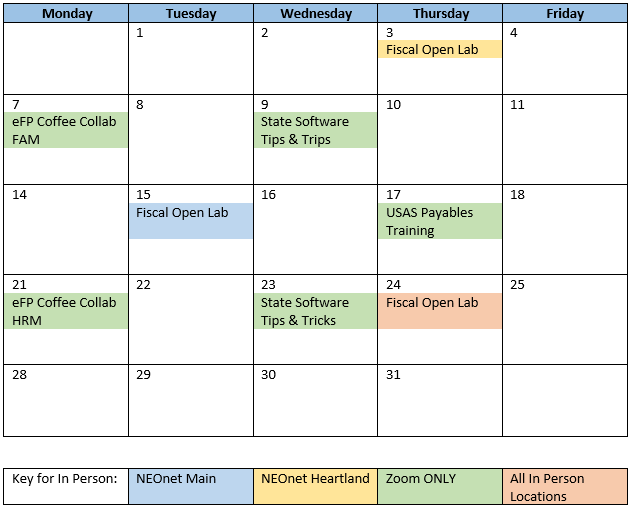

Trainings/Meetings in August