Quarterly Treasurer Meeting Update

As NEOnet continues to evolve and improve our processes, we are excited to announce a change to our upcoming Quarterly Treasurer Meetings designed to provide more focused and relevant content for each group.

New Meeting Schedule:

State Software Treasurers:

- Time: 11:30 AM – 12:00 PM

- Topics: State Software-specific discussions and updates.

Lunch & Guest Speaker:

- Time: 12:00 PM – 1:00 PM

- Details: Enjoy a complimentary lunch and engage with a guest speaker whose insights will be valuable to treasurers from both State Software and eFP platforms.

eFP Treasurers:

- Time: 1:00 PM – 1:30 PM

- Topics: eFP-specific discussions and updates.

This change will allow us to provide tailored content that directly addresses the unique needs and challenges of each software group. We believe this focused approach will enhance the value of the meeting for everyone involved.

We are confident that these changes will provide a more productive and insightful experience for all participants. Your time is valuable, and we aim to make these sessions as beneficial as possible.

Next Meeting Date:

- Date: September 25, 2024

- Details: We will provide more details on the specific topics and guest speakers closer to the date.

Thank you for your continued dedication and support. We look forward to seeing you at the next Quarterly Treasurer Meeting!

Websites that may be useful to Fiscal Departments (sign up for emails):

Office of Budget and Management – state financial information, grant opportunities

State Teachers Retirement System – Employer – Billing/Payments, Reporting, Webinars, Resources

*Per Pay Payments

*New Hire Reporting

*Employer Report once per year

*Salary Estimates once per year

https://www.strsoh.org/employer

School Employee’s Retirement System – Employer – Billing/Payments, Reporting, Webinars, Resources

*Per Pay Payments

*New Hire Reporting

*Employer Report once per year

*Salary Estimates once per year

Ohio Auditor of State – Accounting Blue Book, Findings For Recovery, Audit Information, Sunshine Law, Resources, Training, Ohio Laws, Fraud Reporting, Required Filings and Notifications, Ohio Checkbook

Ohio Bureau of Worker’s Compensation – Employer Resources, Billing/Payments, Reporting, Training

*PERRP Reporting yearly

https://info.bwc.ohio.gov/for-employers

Ohio Department of Education and Workforce – EMIS Manual/Updates/News, Licensure Information, Grant Information, Medicaid School Program

Ohio Department of Taxation – Ohio Tax updates, School District Information, Revenue Accounting Distributions, Real Property Tax Info, County Auditor Info, Ohio Business Gateway Reporting and Payments

https://tax.ohio.gov/help-center/email-us/tax-alert

Ohio New Hire Reporting – The Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996, and the Ohio Revised Code Section 3121.89-3121.8911 requires all employers to report newly hired and re-hired employees to a state directory.

https://www.oh-newhire.com/#/public/public-landing/login

FIRE Transmitter Control Code – required by each district admin to electronically submit 1099’s

OH-ID – needed by each individual to access information and submit information.

https://ohid.ohio.gov/wps/portal/gov/ohid/help-center/help-logging-in

ID.ME – needed to access federal information.

CMS.gov – Prescription Drug Coverage

*Sample Notice

*Reporting once a year

https://www.cms.gov/medicare/employers-plan-sponsors/creditable-coverage

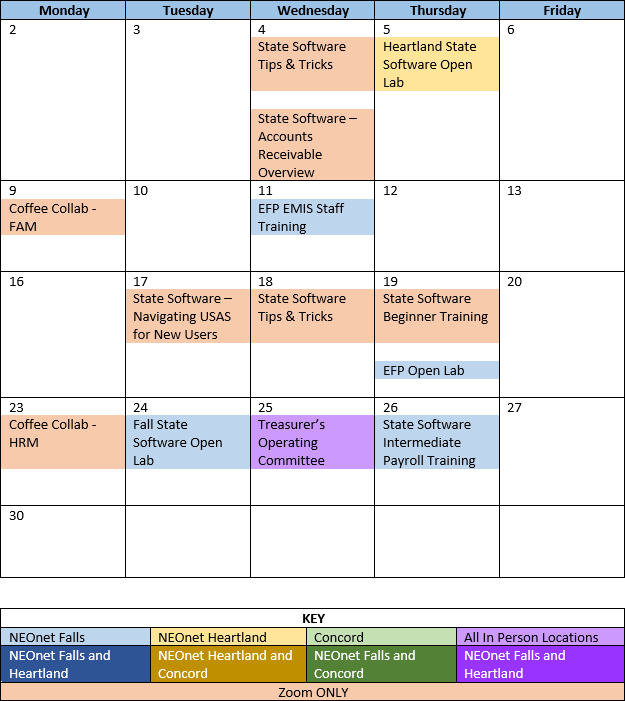

Trainings/Meetings in September