eFP Pre-Calculation Reports Output to Excel

With the 22.4.23 release in July, you can now export Payroll Pre-calculation Reports directly to an Excel format. This enhancement aims to provide you with greater flexibility and convenience when processing payroll.

The following reports are included in the Excel File:

- Pay Run Parameters

- Pre-Calculation Exceptions

- Leave Without Pay (LWOP) Summary

- Pre-Calculation Journal

- Pay Details (New)

- Deduction Details

- Deduction Summary

- Pay Summary

The Pay Details report is new and is only available as an Excel report. It is like the pre-calculation journal report, but it will only include pay and leave information.

Verifying FY23 STRS Advance is Completed

Now that the STRS advance is behind us for another fiscal year, did your reported STRS amount on the annual submission file match what was withheld from your employees and sent to STRS over the summer pays? There are a few quick steps that can be taken to ensure those two amounts balance.

After the last pay of the fiscal year, go to Core>Organization. If the ‘Amount Paid Back’ is equal or greater than the ‘Advance Amount’, then the ‘Advance Mode’ checkbox will be unchecked, and you are no longer in the advance. When the “Advance Amount’ advance flag is unchecked, the ‘Amount Paid Back’ will always display zero. If the ‘Amount Paid Back’ is less than the ‘Advance Amount’, the ‘Advance Mode’ will remain checked. This indicates the district is still processing in the ‘advance mode’ and your STRS advance did not balance. Further steps are necessary.

TheCheck STRS Advance Report (a report of the amounts sent to STRS over the summer pays) is an easy way to assist in determining the balancing discrepancies.

- Go to Reports>STRS Reporting>Check STRS Advance.

- Start Date = Period ending date of the first pay in July.

- End Date = Period ending date of the last pay of the fiscal year.

- Sort By = Choose the same sort option that was selected for the STRS Advanced Positions Report.

The Check STRS Advance Report can be compared to the STRS Advanced Positions Report (created during the fiscal year-end closing process). If you need the STRS Advanced Positions Report, a copy of the report can be generated by going to Utilities>File Archive>2023 Fiscal Year Reports>STRS Advanced Positions Report. For each employee listed, the amount listed as ‘Total Amount Advanced’ on the STRS Advance Positions Report should match the ‘STRS Advance Amounts’ on the Check STRS Advance Report.

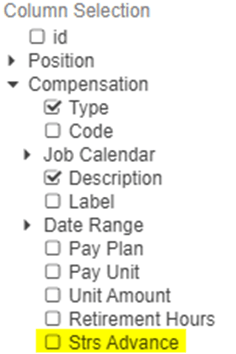

It is also important to verify that all Compensations no longer have the ‘Strs Advance’ checkbox marked. To ensure that all Compensations are flagged properly (false), do the following: Go to Core>Compensation and add the ‘Strs Advance’ field to the grid.

You can email fiscalhelp@neonet.org if you have anyone who is still in Advance and we will work with you to get them out of Advance.

Reminder: At the bottom of the Payroll Report, there is a total that is STRS advance specific called ‘Payroll Item Strs Advancement.’ This value should be $0.00.

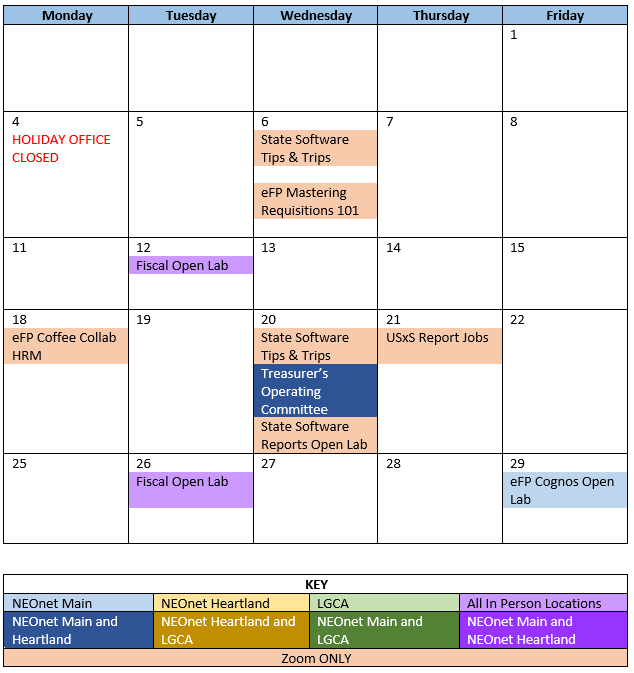

Trainings/Meetings in September